Depending on the location of your business, you may be charged a Value Added Tax (VAT) on your monthly invoice.

If your business is based in the UK, there will be a standard 20% VAT added to your campaign spend. You can reclaim this tax at the end of the year by adding a VAT number upon signing up.

If your business is based in the European Union, but not part of the United Kingdom, you can prevent being taxed by adding in a VAT number when creating your first campaign.

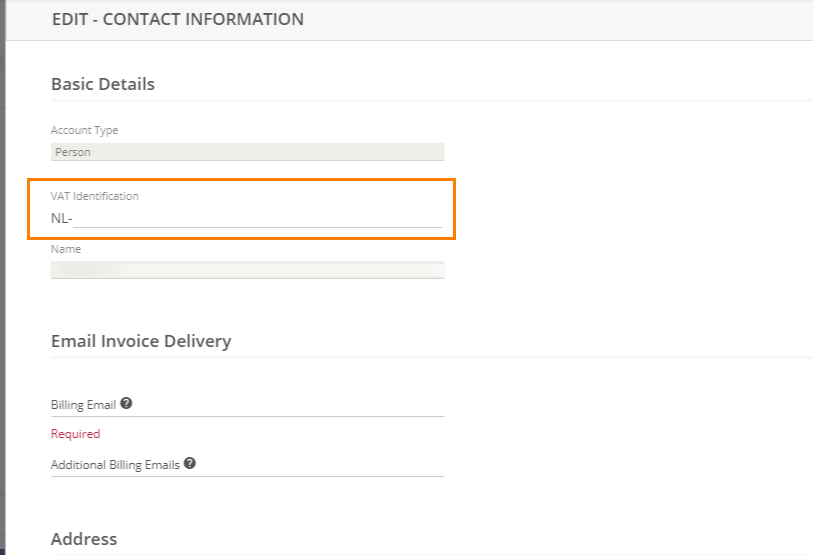

To add or update a VAT number, simply edit the Contact Information on the Payments tab.

Important to Note

- Not entering a VAT number means that you will be charged the standard rate of your billing country.

- For security reasons, your VAT number must be based in the same country that your billing address is located in.

- Any VAT changes will be reflected only on your future invoices.

If you have any questions, feel free to reach out to the DIY Customer Success team.