COVID-19’s Effect on Media Consumption (And 5 Trends to Note)

COVID-19 — the coronavirus disease that’s currently pervading everything, from our behaviors, work routines, and health awareness, down to our newsfeeds.

Together, we’re approaching uncharted territories as each and every individual around the globe is feeling the impact, both personally and professionally.

During a pandemic, of course, there are major shifts in the way people think, feel, and act. What’s critical for brands is understanding the shifts to better manage their responses going forward.

At Outbrain, our focus is on creating meaningful discovery experiences for consumers. Through our direct media partnerships, we’re very fortunate to be able to access over one-third of the entire internet-connected population, providing us with a bigger picture view of the shift in consumer behavior and media consumption.

Media Overload

We’re all consumers, even us marketers! We know how we typically consume content — when we have time for it. During our morning commute, at lunch, and during our evening commute.

Given many of us are now at home, without choice, those typical consumption spikes have greatly flattened as we’re consuming media throughout the entirety of the day.

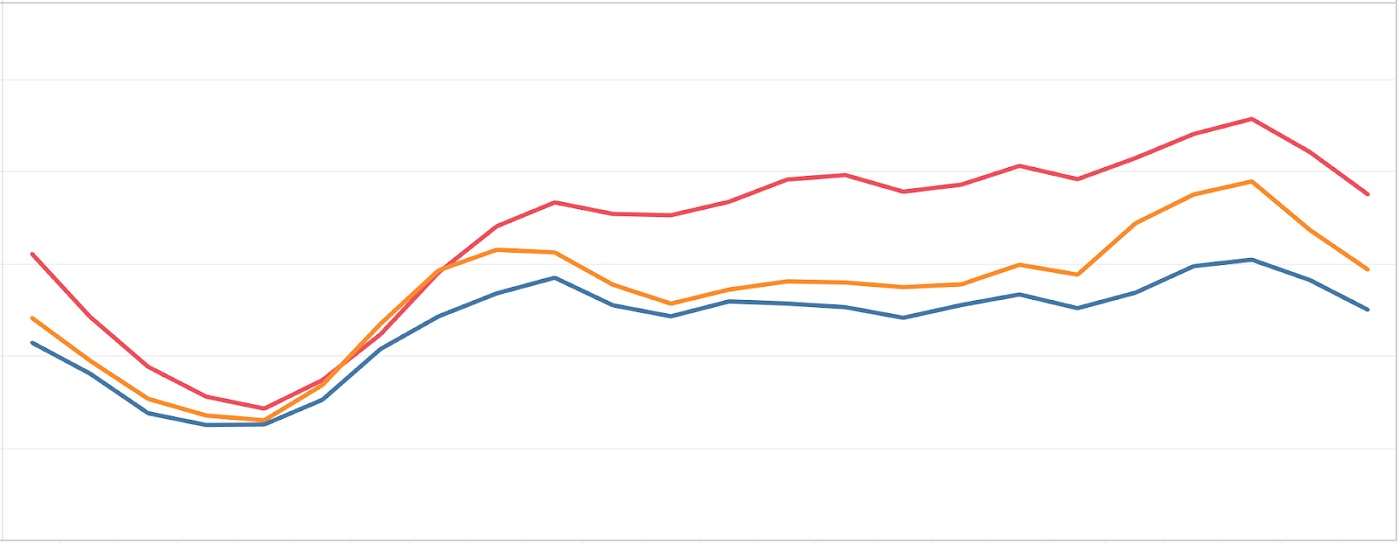

Graph: Mobile Traffic View Mid-Pandemic; Reviewing Weekly Pageview Trends.

(Red = Week of March 15th; Orange = Week of March 1st; Blue = Week of February 23rd)

These consumption shifts are considerably impacting brands. So, to help manage the impact, we’re sharing five behavioral trends, and actions marketers can take as a result.

5 Trends to Note (And Actions to Take)

1. Online Traffic Is Surging

Surging is putting it lightly.

Week over week, the global Outbrain network experienced double-digit growth — 13% specifically, trending up steadily. Coronavirus-related content spiked by over 18% in the U.S. alone, with similar gains seen around the world, from Spain to Singapore.

But don’t just take our word (or, data) for it.

- GlobalWebIndex: 4 in 10 consumers are reading the news more frequently.

- Axios: Up to 15% of all web traffic is to content explicitly mentioning coronavirus.

- Content Square: Media site visits spiked by up to 16.8% with time on site skyrocketing up to 22.1%.

Consumers are looking for answers — updates from the government, knowledge on symptoms, tips to #FlattenTheCurve, and much, much more. And with the added time sanctioned at home, they are doing so more frequently throughout the day.

💡Marketer Action: Reconsider your campaign budget caps, if budget allows. And work Programmatic or Video campaigns into your digital mix.

Given the surge in traffic, we’re seeing marketers hit their daily or campaign budget caps much earlier in the day, missing the opportunity to connect with new audiences later on.

As a result, marketers with elastic budgets are reaping the benefits. So, if budget allows, consider raising your budget cap, or removing the cap altogether, if performance is strong.

Also, given the surge, we found that marketers utilizing Programmatic or Video campaigns are experiencing heightened performance given the automated bidding process of Programmatic and engaging ad experience of Video. Consider testing either (or both!).

2. Traffic Is More Premium

Our network is made up of publishers, media outlets, and mobile carriers of all shapes and sizes. One strength we’re well known for in the native advertising space is our exclusive partnerships with the most recognized media companies in the world.

Given the sensitivities of the global pandemic we’re facing, a great deal of the surged traffic is going to the more familiar publishers, such as CNN, as there’s an automatic consumer trust gained from the brand recognition.

While pageview growth is heightened throughout the entire network, we’re seeing the more premium publishers gain 2x higher growth compared to others.

💡Marketer Action: Take advantage of the lower-cost, higher-impact traffic available.

Premium traffic can be competitive and costly to acquire, pending the quality of your ad experience. While it’s not possible for marketers to only target individual publishers per se (i.e. you can’t just target CNN traffic), there are ways to optimize toward high-impact placements.

For example, there’s a CPC adjustment feature within the Outbrain dashboard, allowing you to increase, or decrease, your publisher or publisher section (i.e. CNN Sports within CNN) bids.

For top-performers, consider increasing bids by 25% to 50% to lift the competitiveness of your campaign within the network and gain more traffic. Though be sure to keep an eye out to ensure your bids don’t negatively impact your CPA.

3. Consumption Times Are Shifting

Similar to the graphs we shared above, consumption times are shifting as more consumers are confined to their homes and local neighborhoods. Instead of the usual media spikes during commuting or meal hours, we’re seeing more of a flat rate of consumption throughout the course of the day.

Across our network, we also noticed that there’s a late evening uptick — around 9:00 PM local — especially in countries that are experiencing stricter regulatory lockdowns, highlighting that consumers are staying up later to interact and discover online.

💡Marketer Action: Consider removing Campaign Scheduling (or, Dayparting) targets, and test later evening targeting times.

You’ve likely gained enough insights to know which times your audiences convert best, and as a result, utilize scheduling tools to tighten your budget around those high-performing times. Given the shift in behavior, we recommend testing a campaign without your usual scheduling times to see if the flattened consumption spikes help your performance.

While you’re testing, consider that 9:00 PM sweet spot of heightened activity.

4. Some Verticals Are Thriving, Some Verticals Aren’t (But Can)

Overall, performance trends are strongly associated with both the type of marketer, as well as the vertical or category they, or their content, fit. Which as we know, is to be expected given the crisis we’re up against.

For example, with travel bans in place, the Travel vertical is experiencing major business pains, whereas Home & Lifestyle is experiencing the opposite.

Conversions have dropped for Brands, fluctuated for Search, developed for Affiliates, and surged for Publishers (News + Media), who are largely driving the 69% increase in clickthrough rates that we’re seeing.

Thriving Verticals:

- Home & Lifestyle = Significant growth in all categories.

- Business & Finance; Investing + Careers = CTR increases up to 73%.

- E-Commerce = Weekly growth rate of 52%.

- Entertainment; Games, TV, Movies, Music, Books = CTR increases averaging 70% with Music specifically seeing a 5x increase (with little to zero price fluctuation).

- Health & Fitness = Significant growth in all categories.

- Recreation = RPM growth with potential for Marketers to tap into.

💡Marketer Action: Vertical ad types matter — try to tailor your content accordingly. And remember, your product or service may fit one category, but that shouldn’t deter you from building content around related, high-performing categories.

Consider audiences’ true interests — Outbrain’s secret sauce given our algorithms are based on interest, not intent (Search) or sharing (Social). While your vertical may be hurting during this immensely difficult time, the audiences who are interested in your vertical are very likely interested in other, potentially unaffected verticals as well.

Be sure to utilize Audience Interests to gain insights from your Outbrain dashboard, as well as Interest Targeting to focus your efforts toward performing interest categories.

We’re seeing great brands shift gears with the shift in consumer behavior that can help inspire you. Take Fitness or Live Entertainment for instance — both who thrive on physical activities are shifting to digital given closures and bans against large group meetups.

5. Platform Performance Deviation

There’s an interesting platform deviation across our network, pending whether or not the content is Coronavirus-related or not. Be sure to take note!

While heightened, all-encompassing traffic patterns are remaining Mobile-skewed, given the ongoing consumer shift to Mobile devices (and the more cost-efficient CPCs mobile campaigns often allow for).

Though interestingly enough, when it comes to Coronavirus-related content, Desktop campaigns are performing stronger than their Mobile counterparts. Following the trend in WFH policies, this is likely due to the developed use of Desktop computers, away from the typical effects a work environment might have on media consumption.

💡Marketer Action: Be sure to break out campaigns by platform, and think mobile-first for non-coronavirus-related content and desktop-first for the opposite.

Can’t stress this enough — please be sensitive with any and all coronavirus-related content. Ensure it’s informative and fact-based, and note that many ad platforms, including Outbrain, have significantly tightened ad guidelines surrounding the current global climate (i.e. facemask ads are a no-no).

Deep breaths, folks. We’re facing difficult yet interesting times as we attempt to balance our typical day-to-day with a new reality that’s felt by each and every one of us.

Wherever you are, the Outbrain family is wishing you, your families, and your businesses good health. And remember, there’s always sunshine beyond the clouds — we’re in this together, and we’ll get through this together.

![The Guide to Creating High-Conversion Content for Your Outbrain Campaigns [Download]](https://www.outbrain.com/blog/wp-content/uploads/2024/05/how-to-create-high-converting-content-for-your-Outbrain-campaigns.png)

![[Infographic] Which Ad Headlines and Images Catch Your Readers’ Attention?](https://www.outbrain.com/blog/wp-content/uploads/2024/01/ad-headlines-and-images-best-practices.png)