[COVID-19] Newly Uncovered Trends, and What They Mean for Marketers

As I sat down to write this, I found myself listening to Gary Clark Jr’s solo rendition of Things Are Changin’ — it resonates.

While in my home base of New York City, much of our daily lives remain the same — WFH schedules, Zoom calls with our families, masked outdoor walks — things are definitely changin’.

How we interact, how we behave, how we consume… how we live.

Just two months ago, when the pandemic started taking a turn for seemingly the worst, I penned an article about how Coronavirus is shifting consumer behavior, though as I review our native network data day over day, again, things are changin’.

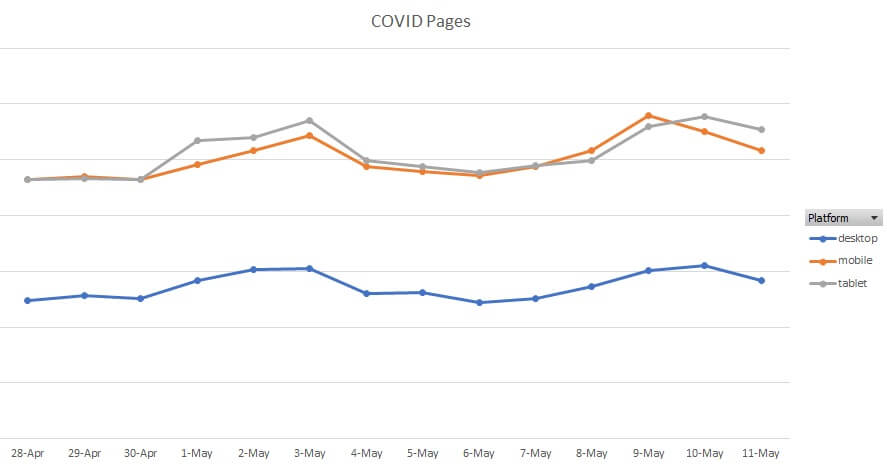

Take #5 of that article, for instance — ”Platform Performance Deviation”. Two months ago, COVID-related content was performing better on Desktop than Mobile, yet re-reviewing the data again from the last few weeks, that insight has been flipped on its head.

Graph: By-Platform Performance, April to May 2020

In the last two weeks alone, Mobile has seen the widest gap in performance with 11.6% more engagement on COVID-related content than non-COVID. Though in that same time frame, Desktop performance has continued to drop, each week.

As our consumer behavior continues to shift, it’s only fair that our Marketing continues to shift with it. So, I beckoned my crystal ball — and by crystal ball, I mean Outbrain’s fantastic Data Insights team (thank you!) — to uncover what new trends are emerging, and how Marketers can follow suit in their responses.

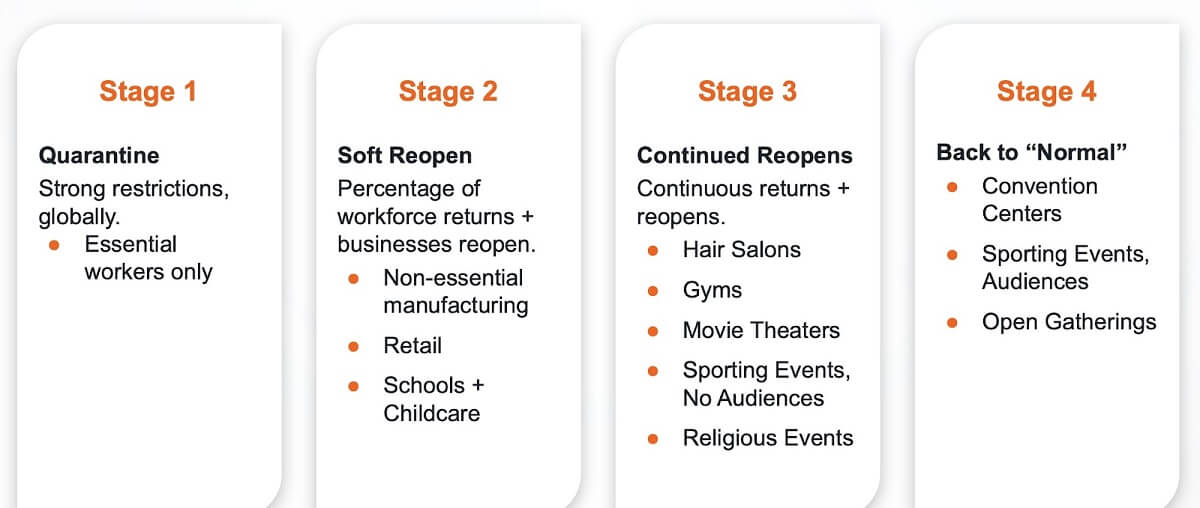

Progressive Stages Back to “Normalcy”

As each region manages its own progressive steps back to “normalcy”, we’re finding commonality throughout the stages in doing so, and for ease of alignment, will share an interesting trend we’re seeing across each stage.

Pending where you are in the world, and which markets you’re targeting, understanding which regions are in which stage will be helpful for your campaign response.

Marketing in or targeting the U.S.? It’s very much still in Stage 1. Spain? Closer to Stage 2.

Emerging Trends By Stage

We’re not going to mask ourselves as fortune-tellers — think we can all agree that there’s a ton of uncertainty surrounding this entire pandemic experience.

Though we are lucky enough to be connected to a third of the world’s internet-connected population (yes, really — over one billion global unique users), and with that comes great insight into behavioral changes over time, and predicted changes for the future.

Alright, seatbelts on as we jump into the data DeLorean!

Stage 1: Gender | Consumption

Typically, our network sees a complete 50/50 gender split, globally (#EachForEqual). Though throughout a heavily-sanctioned quarantine, what we’ve now seen is a huge surge in male-specific users — 38% more, to be exact.

Interestingly enough, even with that surge, female-specific users are proving to be more engaged — by 4.8%, reviewing incremental clickthrough rates over time.

Diving into a regional view, we’re discovering exceptions to this finding, most predominantly in Brazil, where 75% of the country’s audience is female, with much higher engagement to match. Similar insights were found in Belgium as well.

On the flip side, in countries like France and Spain, we’re seeing engagement oppositely spike for males, despite audience sizes being fairly even.

💡Marketer Tip: While we often recommend coinciding run-of-network and targeted campaigns (avoiding too, too much hyper-targeting, of course), now is an interesting time to test demographic targeting by region, pending your product or service type, especially in regions predominantly in Stage 1.

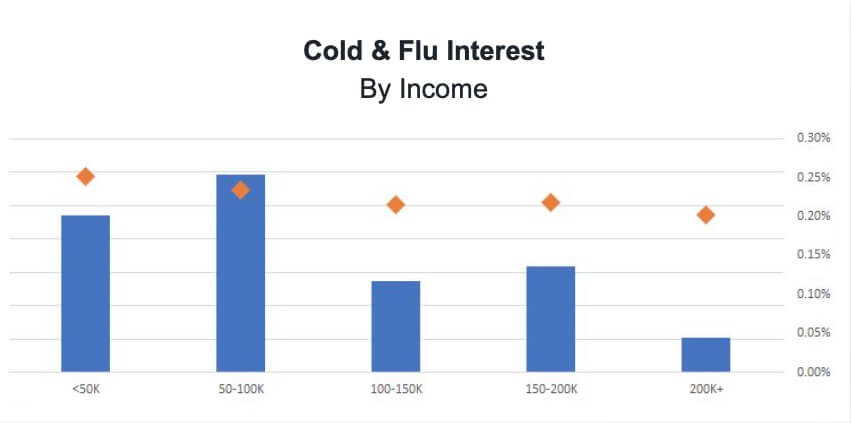

Stage 2: Cold & Flu | Income

Cold & Flu might not sound entirely surprising given the state of the world (and the often-compared to flu-like symptoms of COVID-19), though digging deeper, there’s more of a story to be told.

Associated with the soft reopening of Stage 2, we’re finding a permeation of affluence related to this interest category. Over 73% of consumers interested in Cold & Flu-related content earn more than $50k annually — higher than the U.S. national average, and globally, deemed high.

On the Outbrain network, this category falls much heavier toward scientific and fact-based content (not Politics or News-related), so taking this affluent category a step further, we can also assume that audiences interested in this tend to lean higher-educated as well.

💡Marketer Tip: Native ads are based on consumer interests, which is where features such as Outbrain’s Interest Targeting (and Audience Insights Reporting) can expand your consumer horizons. If your product or service is pricier, or a “non-essential” in these times, this Cold & Flu interest can pose as a targeting proxy for affluent, educated consumers.

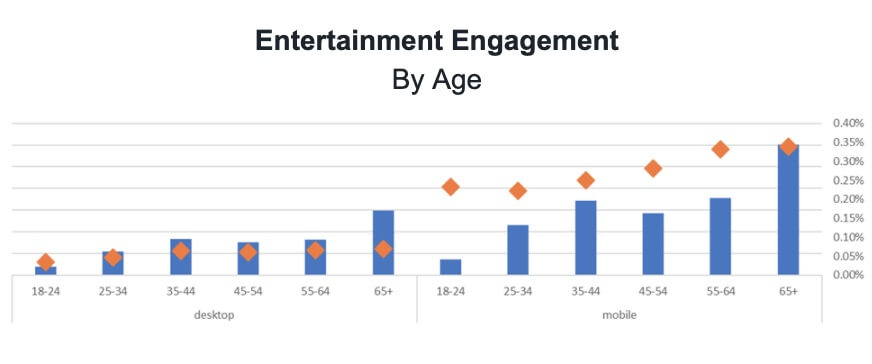

Stage 3: Entertainment | Age

Once dominated by the younger demographics, Entertainment-driven content — such as articles related to Gaming or Virtual Reality — is now shifting toward the older generations, especially on Mobile.

Given the heavy quarantine restrictions globally, the Entertainment category had already spiked in the last few months, though over time, has continually shifted upward in age.

The highest engagement for this category is very specifically being seen in adults aged 55 to 64, and most predominantly in Europe. Though while this stands true on Mobile, Desktop performance continues to skew toward the younger generations.

💡Marketer Tip: Even as reopens continue into Stage 3, consumers are reluctantly nervous to chance their lives for a night out, so Online Entertainment will continue to spike over time. And given the heaviness of the experience, all ages are finding their inner child again to lighten up the stressors of their days. Consider that, if you’re targeting (or your product or service fits) this category.

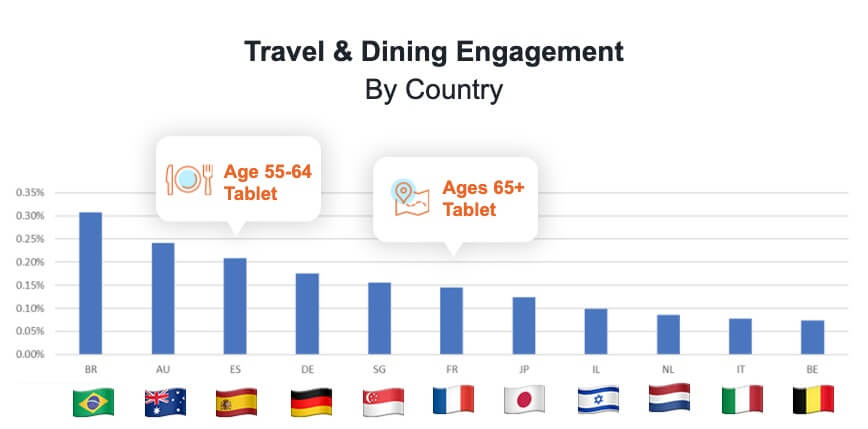

Stage 4: Travel & Dining | Regions

Travel & Dining, two of the most negatively affected verticals amid COVID-19, are beginning to see a comeback, folks. Especially in France and Spain, which could highlight an early indication that these countries are starting to see a light at the end of their COVID-tunnels, and planning accordingly.

Quite honestly, this data insight brought on a small shimmer of relief for me (and hopefully, does the same for you!).

Though it’s very important to note that we’re seeing a strong correlation between national policies and positive resurgences. Where countries took on a national policy to flatten the curve is where Coronavirus restrictions are slowly but surely being lifted, and seeing higher engagement as a result. Though countries with more regional policies, such as the U.S., will likely not see similar types of performance for some time now.

💡Marketer Tip: Don’t lose hope on the considered “non-essential” categories, such as Travel, though be sure to take both location and stage into consideration as you continue your campaign launches and updates.

Maintain Hope, Marketers!

Remember, things are changin’ but there’s hope to be had — while there are many unknowns, we still have consumers’ needs to fulfill as we begin to resurge into our “new normals”.

Be thoughtful. Be reliable. Be honest. Be consistent. And be purposeful in your continued approach. And we’ll continue to share interesting data insights along the way that can help you tailor your digital practices accordingly.

And as always, from our Outbrain family to yours, we’re wishing you nothing but safety and good health. And if there’s any support we could provide, know we’re always here to help.